In final months of 2010, at the height of the Wikileaks scandal, the major online financial institutions VISA, Mastercard and Paypal moved to cut off the supply of donations to the site, under pressure from powerful governments around the world. Faced with ruin, Wikileaks turned to an alternative currency. One that wasn’t controlled by any government around the world. A currency that had essentially been created with the press of a single key, by an enterprising young programmer who was known in the cybersphere as Satoshi Nakamoto. It was called bitcoin.

Twenty years of aggressive growth on the internet has given us a string of dotcom billionaires. From Larry Paige to Mark Zuckerberg, the ability to conjure up vast sums of money simply by having the right idea at the right time is nothing new. But what Nakatomo was trying to achieve with bitcoin was something different. His system mimicked the popular peer-to-peer networks already used by millions to download and share their favourite games, movies and music; it also incorporated new anti-spamming and cryptography technology, which would enable it to create money literally out of nothing.

It functions on a simple principle. Bitcoins can only be produced by completing complex mathematical puzzles, a process referred to as mining. The puzzles require a real world investment, in terms of computing power and the energy required to run a processor, and prospectors are rewarded by the occasional trickle of bitcoins into the system. The more miners there are, the less each one receives, and the system is designed to run for a twenty year period, yielding no more than 21 million bitcoins. It is the combination of these factors that give bitcoins their value, in much the same way as gold acquired more value than water in the ancient world, because it was limited in quantity and took a great deal of effort to extract.

Almost as soon as mining began, Bitcoin exchanges opened on the web. If you can’t be bothered spending your own money on a mining effort, then you can simply buy a miner’s coins with conventional money through a more traditional digital currency system such as paypal. At the peak of their value, a bitcoin was worth more than 15$ although market fluctuations and other factors have since brought the price back down to about 5$.

For your cash, you get what is essentially a block of uniquely encrypted data. It cannot be replicated, and because every copy of the program keeps a record of where every bitcoin was created, it would take a million times more work to fake the file than to create a real one. If you delete the encrypted data, or damage the computer it’s stored on, it’s gone. Other than that, it works just like any real world commodity. You can spend it at an exchange, or with a retailer – anyone else who runs the bitcoin software. You don’t register your name, and none of your personal details are included in the coin.

Everything is tied to a single bitcoin address, secured by incredibly complicated, paired encryption keys. The irony is that the supposed anonymity of bitcoins is a fallacy. The lengthy chain of data encrypted by each computer includes all of the transactions ever processed by the system, linked to the various IP addresses of the users. With enough forensic investigation, any particular transaction can be traced back to a physical location. There are now sites that offer what is called a bitcoin “fog”. This fog acts as a mixing service where funds transferred to the fog get mixed with other users’ funds and when requested are paid out in multiple randomized transactions to further obscure the source of the money.

So why did Satoshi Nakamoto create bitcoin, and suddenly disappear off the face of the web? He had done nothing illegal and he didn’t stand to make some outrageous, immoral level of profit from floating the company a year down the line. Like a 21st century Salk, the creator of the polio vaccine, he gave his invention away. There have been suggestions that Nakamoto hoarded a stash of bitcoins before the software’s release, and that at the optimum moment in the bitcoins twenty-year lifespan he will release them onto the market and make millions. But like everything else surrounding Nakamoto, it is merely rumor, heaped on speculation, stacked on a wobbly pile of guesswork. Is he a single individual? A cadre of programmers working under a collective alias?

The other coders credited with developing the bitcoin technology, and with maintaining it, stay tight-lipped about his identity. For them, the individual isn’t important. The project is more about good old-fashioned rebellion; a reaction to the financial irresponsibility demonstrated by the world’s leading institutions over the last five years. It’s about taking digital currency out of the hands of administrators and governments and putting it back in the hand of the private individual.

AND…

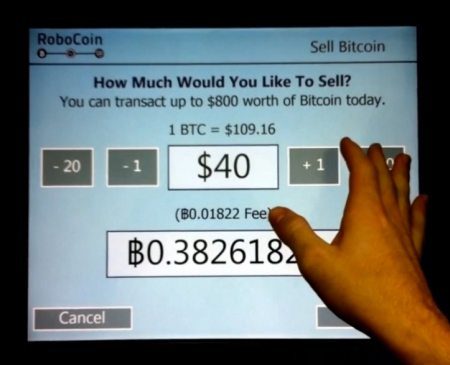

While the established digital currency guys (MasterCard, Visa, etc.) are still struggling with the fact that they cannot cash in on this cash flow, bitcoin has not crashed and burned as so many in the financial sector predicted in its early days. Quite the opposite. Now you can buy, sell, and take out physical currency all over the world via Bitcoin ATMs. It’s widely accepted at retailers and other businesses online and in the brick and mortar world. The transaction fees to accept Bitcoin as payment for goods and services is far less than credit cards and PayPal, and the cost is expected to decrease. It’s certainly a much safer transaction than using your debit or credit card and has no exchange rate.

Bitcoin’s value is predicted to increase substantially in 2016, and investors now view it as a sound way to grow your money. Yes, it’s a bit volatile, but is that really much different than investing in the stock market, or Forex trading? Growing money has always had some risk, if it doesn’t you’re not getting much of a return. They anticipate a single bitcoin to be worth $400-$600 USD by the end of 2016 and more than $1000 in 2017. One venture capitalist thinks it will be akin to gold as an investment vehicle next year. Price Prediction for 2016

The success of Bitcoin has proven that a currency does not need a central issuer to be valid. The population can bypass the established system, and in a way that keeps your money safer than the big banks. When Bitcoin reaches its life expectancy, someone will have already created what will take its place… that’s my prediction 🙂